Temporary Rate Buydowns to help borrowers lower their interest rate for the first 12 to 36 months of their mortgage for the purchase of a primary residence or 2nd home.

BENEFITS

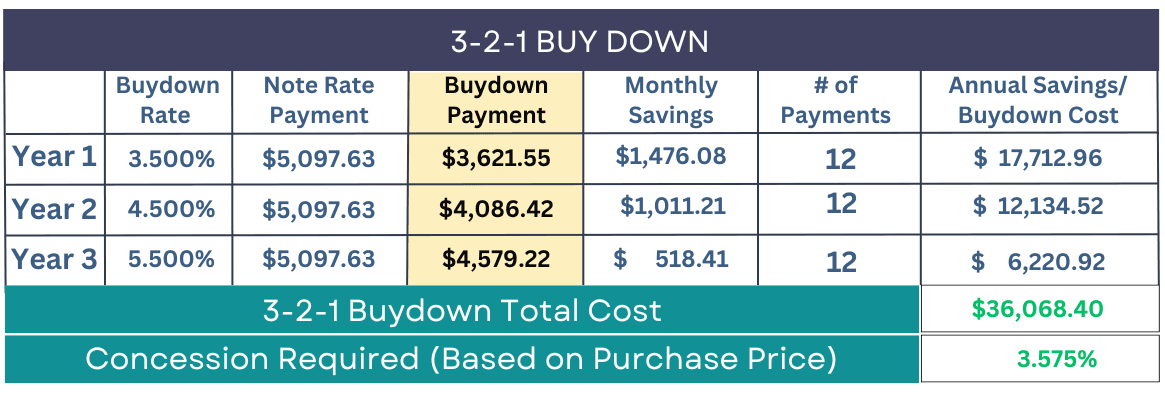

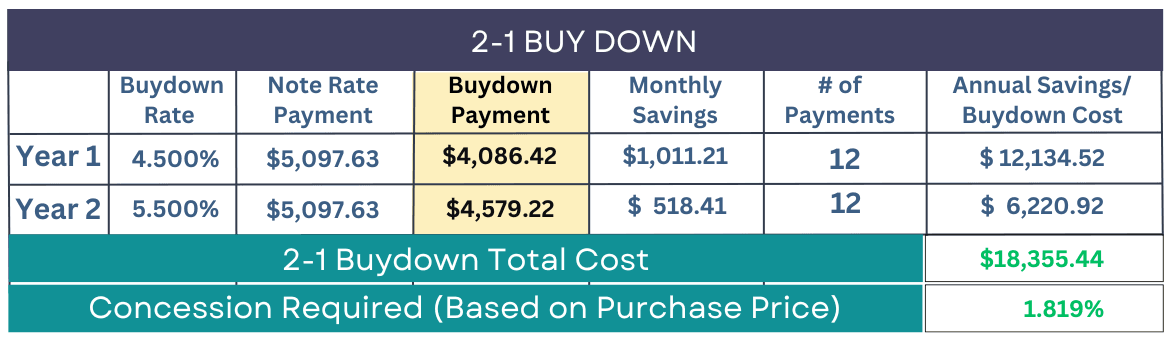

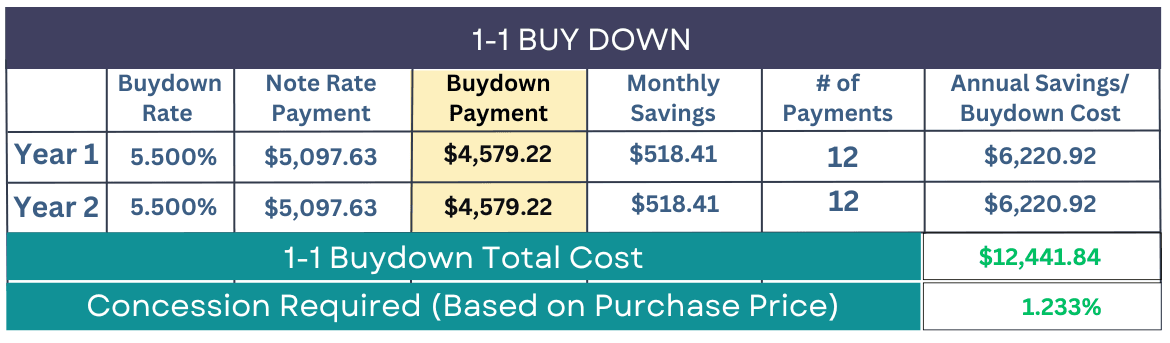

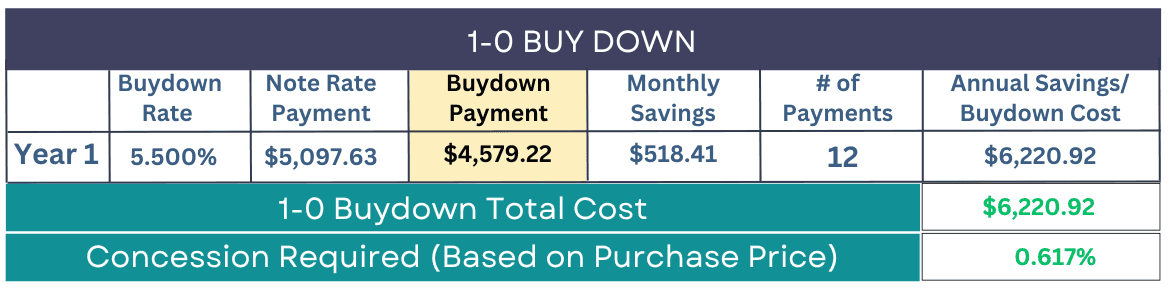

Example below is a 6.5% Note Rate, 6.559% APR for a $806,500 loan amount and $1,009,000 sales price. SFR and 740 credit score. Mortgage Payment listed below is Principal & Interest and for illustrative purposes.

What are your goals? We are committed to helping you reach them.

Tell us what you're looking for so we can match you with the perfect mortgage

We'll search for the top rates from our network of lenders in your area

Your lender will contact you shortly so you get more info or lock in your rate